Leverage our data, research and experience to find the right alternative investment firm with confidence.

Expand Your List of Leading Investors

Get access to the value creation and responsible investment practices of a wide range of North American and European asset managers

Ratings You Can Trust

Ratings are provided by BuildRI, delivering actionable, objective insights to investors

Find Insights

Access case studies of “doing well by doing good” from institutionally-backed companies through the BuildRI software

Leverage Our 20+ Year Track Record

Our Clients and Impact

BuildRI and its subsidiaries are firmly anchored in our 20+ year track record providing responsible investment and value creation insights that have earned the confidence of the world’s largest and most influential corporations and asset managers.

750,000+

Employees

$10+ Trillion

Total Assets

$500+ Billion

Revenue

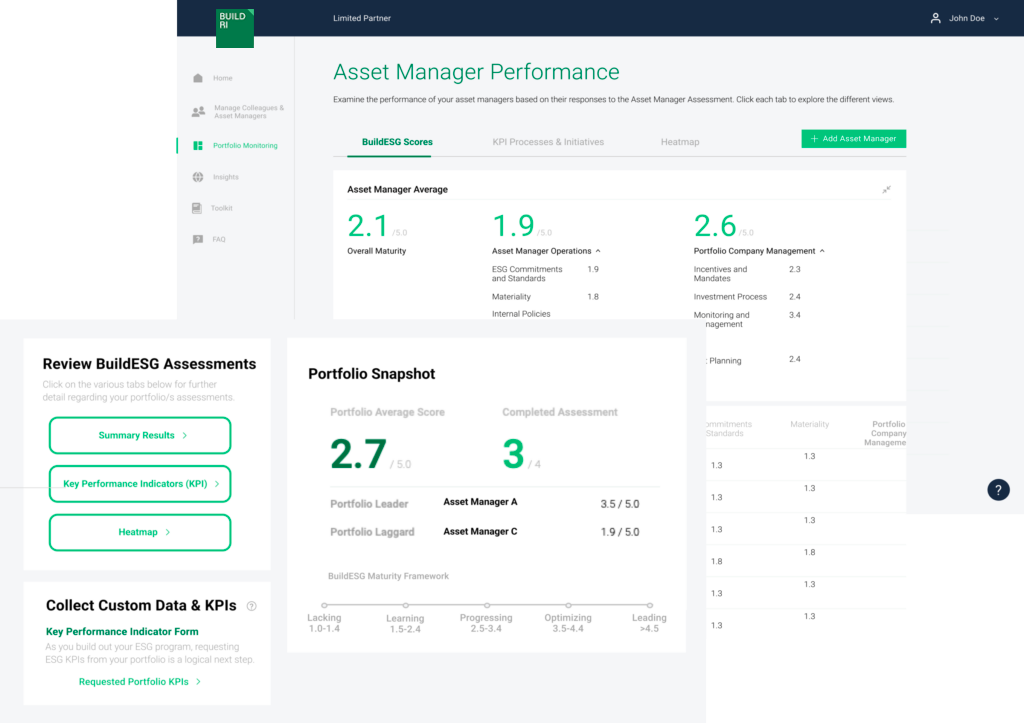

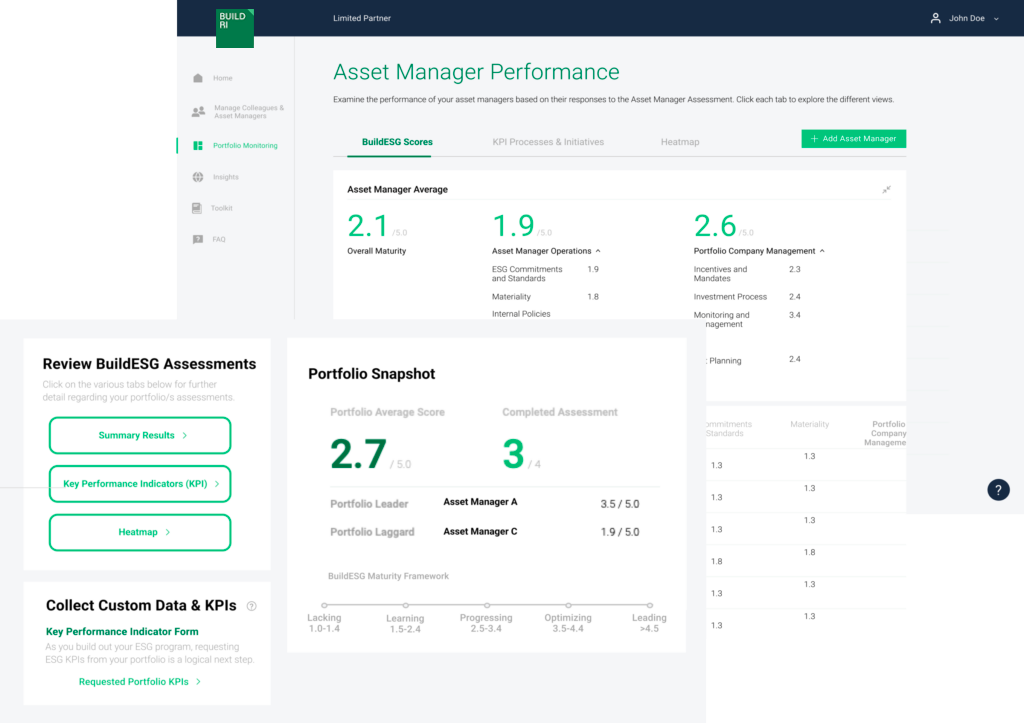

ACCESS DETAILED RATINGS OUR AWARD WINNING PLATFORM

The BuildRI Platform streamlines value creation and responsible investment assessments, making it faster, smarter and more efficient for leading limited partners, lenders and investment managers.

TRANSPARENT RATINGS ALIGNED WITH GLOBAL FRAMEWORKS AND STANDARDS

- BuildRI ratings indicate the maturity levels and integration of value creation and responsible investment practices

- BuildRI ratings are available for managers based upon publicly-disclosed information

- Confidential ratings and content are also available on the BuildRI platform

- Access headline ratings and scorecards on our website and detailed ratings on the BuildRI platform

30,000+

Data Points

30+

Categories Rated

FOR ALTERNATIVE INVESTMENT MANAGERS

Learn more about how you can partner with BuildRI to connect with limited partners, lenders and other stakeholders seeking managers with impactful value creation and responsible investment practices.